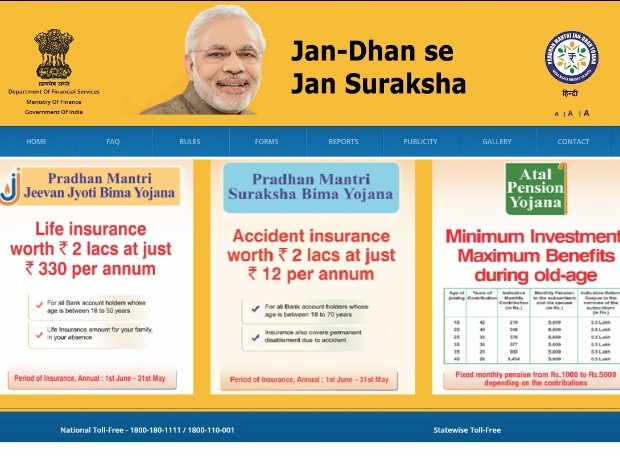

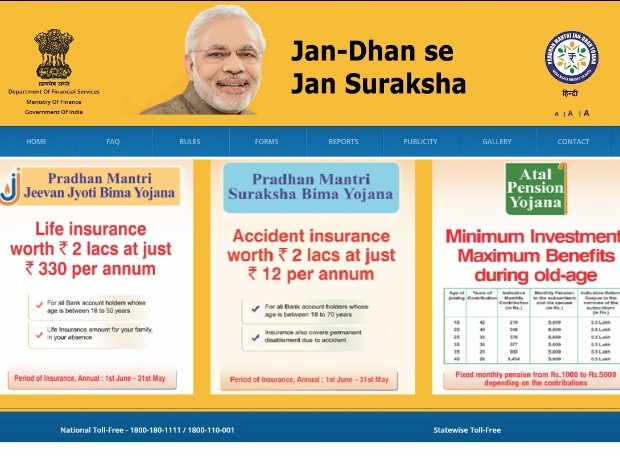

Brief on Atal Pension Yojana

- Atal Pension Yojana (APY) is open to all bank account holders.

- The Central Government would also co-contribute 50% of the total contribution or Rs. 1000 per annum, whichever is lower, to each eligible subscriber, for a period of 5 years, who join the APY before 31st December, 2015, and who are not members of any statutory social security scheme and who are not income tax payers.

- Under APY, the

- monthly pension would be available to the subscriber, and

- after him to his spouse and after their death, the pension corpus, as accumulated at age 60 of the subscriber, would be returned to the nominee of the subscriber.

- Under the APY, the subscribers would receive the fixed minimum pension of Rs. 1000 per month, Rs. 2000 per month, Rs. 3000 per month, Rs. 4000 per month, Rs. 5000 per month, at the age of 60 years, depending on their contributions, which itself would be based on the age of joining the APY.

- Therefore, the benefit of minimum pension would be guaranteed by the Government.

- However, if higher investment returns are received on the contributions of subscribers of APY, higher pension would be paid to the subscribers.

- The minimum age of joining APY is 18 years and maximum age is 40 years.

- Therefore, minimum period of contribution by any subscriber under APY would be 20 years or more.

For details: CLICK HERE

[Source: PIB]

0 comments:

Post a Comment