Why in news?

- The deflator is in the news because Chief Economic Adviser Arvind Subramanian has referred to it to show that inflation currently is at very low levels.

- According to Subramanian, the near-flat GDP/GVA deflators indicate that “we are closer to deflation territory and far, far away from inflation territory”.

- Finance Ministry flagged deflation as a challenge for the economy.

“Overall, economic growth is moving in the right direction, although its pace is still below what the economy needs. But it is at a pace that is expected to pick up in response to the ongoing reforms.. and one real challenge that looms ahead appears not to be the price inflation but the possible price deflation,” said chief economic adviser Arvind Subramanian. Pointing to the subdued prices and low GDP and gross value added deflators, Subramanian said, “the data seems to suggest we are closer to deflation territory and far far away from inflation territory.”

- “I don’t know how the economy will evolve exactly. But the combination of oil price decrease, the fact that macroeconomic stability, the fact that reforms (are being undertaken), the fact that inflation is down and interest rates have come down… all of these should contribute towards annual growth towards that have been forecast in the Survey. Higher growth should translate in higher job creation,” he added

What is the GDP deflator?

- The GDP deflator, also called implicit price deflator, is a measure of inflation.

- It is the ratio of the value of goods and services an economy produces in a particular year at current prices to that at prices prevailing during any other reference (base) year.

- This ratio basically shows to what extent an increase in GDP or gross value added (GVA) in an economy has happened on account of higher prices, rather than increased output.

- Since the deflator covers the entire range of goods and services produced in the economy — as against the limited commodity baskets for the wholesale or consumer price indices — it is seen as a more comprehensive measure of inflation.

|

| Image Source: The Indian Express |

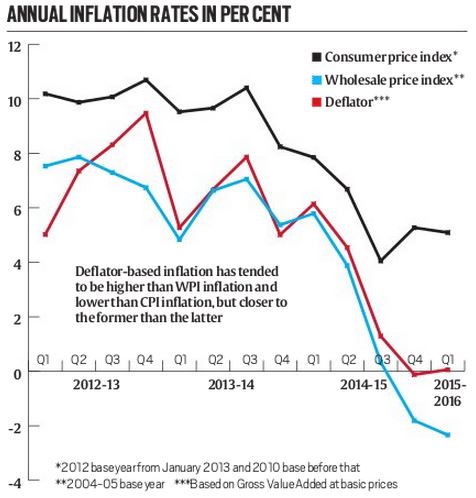

How does this tally with the inflation rates based on the more commonly-known WPI & CPI?

- WPI inflation is already in negative territory for the last 9 consecutive months since November.

- On the other hand, CPI inflation — which RBI employs as the “nominal anchor” for its monetary policy operations — has been much higher

- Deflator is the most accurate indicator of the underlying inflationary tendency (or even deflation, as Subramanian is suggesting), as it covers all goods and services produced in the economy.

- WPI: 676 commodities; all of these are only goods and whose prices are captured at the wholesale/producer level.

- CPI considers inflation at the retail end, while also including services. But since only goods and services directly consumed by households — from foodstuffs, clothing and petrol to health, education and recreation services — are taken, the CPI does not tell us what is happening to prices of cement, steel, polyester yarn or compressors.

- Prolonged negative WPI inflation could, indeed, be indicative of deflationary pressures not being adequately reflected in the CPI.

- The main reason is that it is available only on a quarterly basis along with GDP estimates, whereas CPI and WPI data are released every month.

- The inflation that consumers experience or expect in future is what gets factored in wage bargains and also determines the allocation of household savings across different assets.

- The job of monetary policy is to see that the public’s inflation expectations are firmly anchored, so as to prevent any wage-price spirals.

- Interest rates will also have to be sufficiently above CPI inflation, so that households continue to park their savings in bank deposits as opposed to gold or real estate.

- But the criticism of this approach is that

- it works in normal times, whereas today we have an abnormal situation of deflation — at least from the producers’ end. Given zero, if not negative, WPI or deflator inflation and 10 per cent-plus nominal borrowing rates, firms are effectively paying double-digit real interest rates.

- Savings ultimately come from incomes, which, in turn, are a function of growth and jobs in the economy. Monetary policy will probably have to reconcile itself to this reality. The RBI was behind the curve when inflation took off in 2011-12; it cannot afford to be behind the curve on deflation today.

0 comments:

Post a Comment