THE BLACK MONEY (UNDISCLOSED FOREIGN INCOME AND

ASSETS) AND IMPOSITION OF TAX ACT, 2015

This Act of the Parliament got President's assent on 26 May 2015, notified in July 2015.

Background

- To deal with the problem of the Black money that is undisclosed foreign income and assets,

- To unearth black money stashed overseas by laying down the procedure for dealing with such income and assets and

- To provide for imposition of tax on any undisclosed foreign income and asset held outside India

|

| Source: KMHouse Website |

|

| Source: HT |

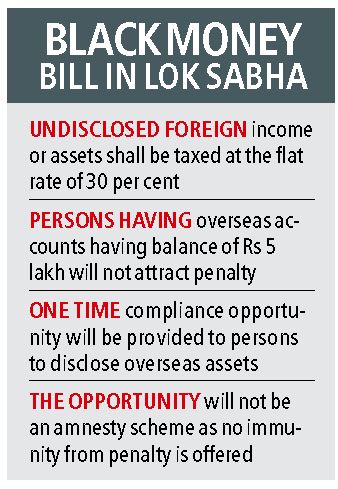

Provisions of the Act

The Act Apply to Indian residents and seeks to replace the Income Tax (IT) Act, 1961 for the taxation of foreign income. It

Detailed provisions

- penalizes the concealment of foreign income, and

- provides for criminal liability for attempting to evade tax in relation to foreign income.

Some notable points

|

| Source:Indian Express |

- Tax rate:

- A flat rate of 30% tax would apply to undisclosed foreign income or assets of the previous assessment year.

- No exemption, deduction or set off of any carried forward losses

- Applicable from April 1, 2016

- Scope of income to be taxed:

- Total undisclosed foreign income and asset of an individual would include:

- (i) income, from a source located outside India, which has not been disclosed in the tax returns filed;

- (ii) income, from a source outside India, for which no tax returns have been filed; and

- (iii) value of an undisclosed asset, located outside India.

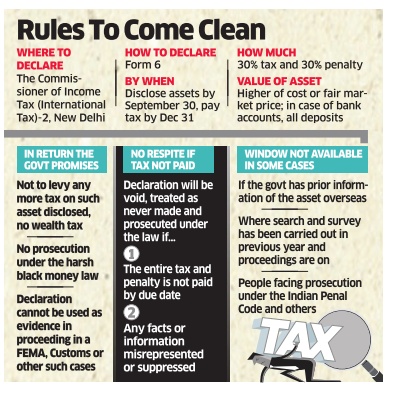

- One - time compliance opportunity: to persons who have any undisclosed foreign assets-for a limited period.

- would be permitted to file a declaration before a tax authority, and

- pay a penalty at the rate of 100%.

- Tax Authorities:

- Relevant tax authorities and their jurisdiction - as specified under the IT Act. /

- powers of inspection of documents, and evidence.

- The proceedings are to be judicial.

- Penalty for offences:

- Undisclosed foreign income/assetsequal to three times the amount of tax payable, in addition to tax payable at 30%Failure to furnish returnsin relation to foreign income or assets (>Rs 5 lakh) is a fine of Rs 10 lakh.Undisclosed or inaccurate details of foreign assets (>Rs 5 lakh)pay a fine of Rs 10 lakhSecond time defaulterliable to pay an amount equal to the amount of tax arrearsOther defaultsIf a person fails to abide by the tax authority in (i) answering questions, (ii) signing off on a statement, (iii) attending or producing relevant documents, he is to pay a fine between Rs 50,000 to two lakh rupees.

- Prosecution for certain offences:

- Wilful attempt to evade tax: rigorous imprisonment from 3 to 10 years, and a fine.

- Wilful attempt to evade payment of tax: rigorous imprisonment from 3 months to 3 years, and a fine.

- Failure to furnish returns: or non disclosure of foreign assets in returns: rigorous imprisonment of 6 months to 7 years, and fine.

- Punishment for abetment: rigorous imprisonment of 6 months to 7 years, and fine.

- Liability of company: For any offence under this Act, every person responsible to the company is to be liable for punishment.

- His liability is absolved if he proves that the offence was committed without his knowledge.

Issues with the act

- Excluded Non-Resident Indians (NRI) from its purview, who are genuine holders of wealth abroad and can earn incomes there.

- They are not obliged to declare their assets or incomes to Indian authorities.

- So, Indians who are moneyed, work out an arrangement with NRIs to hold their wealth and show their incomes through legal arrangements.

- Provisions will be applicable only if the government is able to detect incomes and wealth held abroad.

- has no mechanism for doing so.

- So, the draconian punishment — a jail term and 300 per cent fine — can hardly be implemented.

- An amnesty scheme is being offered to come clean.

- There will be no punishment if one discloses the assets and incomes abroad in the specified period and pays the taxes within 6 months.

- Thus, the inexperienced ones who had held illegal wealth abroad in their own names and earned incomes on them would have a chance to come clean.

- No mechanism to identify funds going out or being held abroad.

- The government argues repeatedly that it will get information via the Double Taxation Avoidance Agreement (DTAA) or Tax Information Exchange (TIE) agreement with a number of governments. However, these agreements have been in place for more than two decades - but there has been no information on black wealth holders.

- Moreover, these agreements are about the declared incomes of individuals and not undisclosed wealth or incomes.

FAQs on Black Money law

Other measures taken by India to fight against Black Money:

[Sources: PRS Legislative Research, The Hindu, PIB, Economic Times, Indian Express]

- The government will give immunity from prosecution under FEMA, Prevention of Money Laundering Act, Income-tax Act, Wealth Tax Act, Companies Act and Customs Act - to persons declaring undisclosed foreign assets under the compliance window of the new Black Money Act.

- If the undisclosed asset has been acquired out of the proceeds of sale of protected animals the person will not be eligible for immunity under the Wildlife (Protection) Act, 1972.

|

| Source: Economic Times |

- Foreign Account Tax Compliance Act (FATCA) with US: requires both governments to exchange financial information on offshore accounts of each other’s citizens in their respective territories.

- The agreement may not be of any great use to India in the immediate context — since the proportion of Indian tax-evaders hiding funds in the U.S. is negligible compared to those doing so in tax havens such as the Bahamas, Cayman Islands and Luxembourg — but signing it was still essential since the U.S. imposes strict punitive measures on companies that are not registered under FATCA. Basically, failure to sign it would have meant companies such as the State Bank of India and the ICICI bank would have become highly uncompetitive in the U.S. The U.S.’s motivation to get India to agree to FATCA is clear: the more signatories there are to it, fewer will be the number of places where tax-evaders can hide. There are 110 jurisdictions that have signed in, including several of the tax havens

- Internationally, India last month joined the Multilateral Competent Authority Agreement (MCAA) on the Automatic Exchange of Financial Account Information, which has 59 other members. This ensures multilateral sharing of financial information on an automatic and systematic basis, unlike in the previous system in which only information pertaining to specific individuals would be shared, that too when there was suspicion of wrong-doing.

Conclusion:

Taken together, the Black Money Act, the MCAA, and now the FATCA agreement comprise a formidable system aimed at curbing black money. Indeed, it is the most systematic and concerted effort made by India to date. This commendable and long-overdue initiative will send forth the message that the government is intent on doing what it had promised to do — to curb irregularities involving funds held in foreign lands, and black money.[Sources: PRS Legislative Research, The Hindu, PIB, Economic Times, Indian Express]

0 comments:

Post a Comment